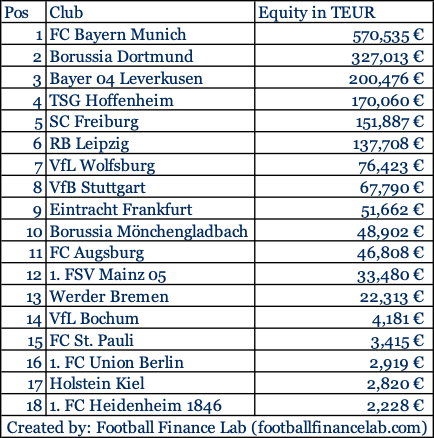

When you think of the unique selling points of the Bundesliga, you think of packed, atmospheric stadiums, lots of traditional clubs and, from a financial perspective, stable clubs that adhere to the 50+1 rule. That is why Football Finance Lab is examining the equity and debt in the balance sheet totals of Bundesliga clubs in this article. Before we analyse the figures and look at an equity table, let’s define equity. Equity is all the financial resources that make up the clubs’ own capital shares. In short, it is all the assets that the clubs own and do not have to repay. In German professional football, there is often talk of FC Bayern Munich’s bulging fixed-term deposit account. This much-cited fixed-term deposit account is, so to speak, FC Bayern’s piggy bank, or the money that the Munich club has in the bank. The following table shows how much equity capital the individual clubs contribute to their balance sheet total from their own pockets. The data is taken from the DFL financial report and is based on the balance sheets as of 30 June 2024. Only four teams, 1. FC Heidenheim, Bayer Leverkusen, Borussia Mönchengladbach and VfB Stuttgart, reported their figures as of 31 December 2024.

As usual, FC Bayern Munich is miles ahead of the other Bundesliga clubs and tops the table with approximately €570 million. This means that the German record champions have more than €240 million more equity in their balance sheet than second-placed Borussia Dortmund. That is more than the total equity of Bayer Leverkusen, which is third with approximately €200 million. Here, too (as in so many Bundesliga financial statistics), Bayern Munich is far ahead in first place, followed by BVB in second place, well ahead of the rest of the league, with the remaining teams trailing behind.

Similar to personnel expenses (here you can find the article on the personnel expenses of Bundesliga clubs), the league can be divided into different clusters in terms of equity capital. FC Bayern Munich and Borussia Dortmund each form their own clusters. They are followed by Bayer 04 Leverkusen, TSG Hoffenheim, SC Freiburg and RB Leipzig, which form the third group with equity capital of between €137 million and €200 million. SC Freiburg is particularly noteworthy here, with total assets of €189,216 thousand and equity capital of €151,887 thousand. When compared to the total assets of the clubs in its own group, this is a particularly high figure. But before we delve deeper into the equity/debt comparison later in the article, let’s take a closer look at the breakdown. The next group lags significantly behind block three and is led by VfL Wolfsburg, which, however, with approximately £76 million, only reaches about half of RB Leipzig’s figure. The Wolves are followed by VfB Stuttgart with £67 million, as well as Eintracht Frankfurt, Borussia Mönchengladbach and FC Augsburg, which have equity of approximately £46-51 million. The penultimate category is completed by Werder Bremen (€33 million) and Mainz 05 (€22 million). In 14th to 18th place, far behind, are VfL Bochum, FC St. Pauli, Union Berlin, Holstein Kiel and 1. FC Heidenheim with approximately €2-4 million.

Why equity ratios matter: How strong Capital bases shape Bundesliga Clubs’ financial stability

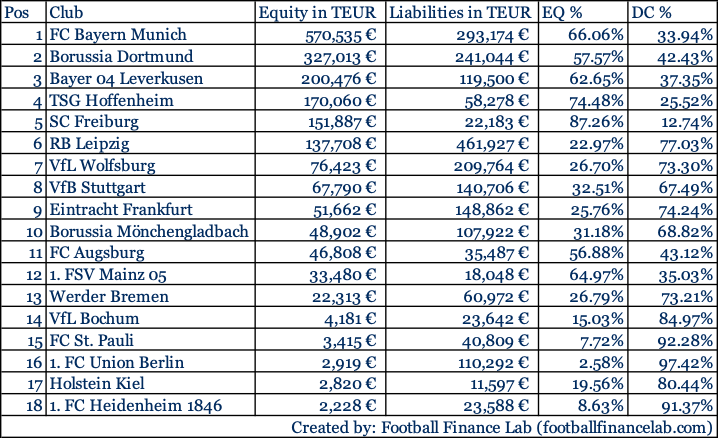

The counterpart to equity capital is debt capital, also referred to as liabilities in a balance sheet total. Debt capital refers to all financial resources that clubs receive from third parties (e.g. banks through loans). In order to be as financially independent as possible, it is important to have as much equity as possible. This gives clubs more freedom to make decisions and also makes it cheaper to obtain debt capital, as the equity serves as collateral. In addition, higher equity capital means that clubs do not have to sell players so quickly in order to improve their balance sheet. This was confirmed, for example, by Axel Hellmann (spokesman for the board of Eintracht Frankfurt) at a general meeting at which a capital increase was to be carried out by selling shares in the limited company to the association. He said: “We could have sold Marmoush in the summer for 30 or 35 million if he had found a club. But it didn’t work out. Thanks to the liquidity we had in reserve, we were able to wait for a better offer. You need a different equity base if you want to run this business model.” According to Hellmann, it is therefore particularly important to have as much equity as possible in order to wait for a player to develop fully so that he can be sold for the highest possible price. This applies to many clubs in the Bundesliga, most of which see themselves as training clubs. Here is the table, expanded to include liabilities and the percentage equity ratio.

If we now look at equity ratios, Freiburg, mentioned in the first part of this article, ranks first with an equity ratio of approximately 87%. This is an impressively high figure, which is uncommon in both the free market and the football business. In the free economy, equity ratios range between 30-70% depending on the industry, with an average of 43% assumed for listed companies across the economy as a whole. SCF is followed by TSG Hoffenheim with an equity ratio of 76%. A group consisting of FC Bayern Munich, Mainz 05 and Bayer Leverkusen follow with 62-66% equity. Mainz 05 is particularly noteworthy here, as it is only twelfth in the overall figures and thus in the lower midfield of the Bundesliga. In percentage terms, Mainz is in fourth place, which is due to its very low total balance sheet. Next come Borussia Dortmund and FC Augsburg with 56/57%. There is then a big jump to around 32% for VfB Stuttgart. VfB is followed by Gladbach (31%), Bremen (26%), Wolfsburg (26%), Eintracht Frankfurt (25%) and Leipzig (22%). RB Leipzig stands out here, as it is sixth in terms of total figures for equity capital, but only 13th in terms of percentage. As with Mainz 05, this is due to the balance sheet total, which is the second largest in the Bundesliga for Leipzig and reflects the financial strength of the Saxons. The bottom five places are occupied by the same five clubs as in the overall rankings, only in a different order. Kiel and Bochum achieve equity ratios of 19% and 15% respectively. Heidenheim, St. Pauli and Union Berlin, on the other hand, are in single digits with 7% and Union even only 2%. This is again due to the differences in balance sheet totals, as Kiel has by far the smallest balance sheet total at €19 million (Union Berlin, for example, has €139 million). From Football Finance Lab’s perspective, the equity ratio compared to total equity says a lot about the economic health of the clubs. In the event of sporting failures, this would not hit clubs with a high equity ratio as hard as clubs with low equity. If, for example, SC Freiburg and Union Berlin were to be relegated, Freiburg would find it much easier to recover financially from this relegation. In this example, Union Berlin would probably have to sell significantly more players than the sports club in order to remain financially viable. In sporting failure, it is generally much more difficult to obtain external capital, which means that without a high equity ratio, the total amount of money available decreases even further, making it even more difficult to achieve sporting success.

Bundesliga Balance Sheets 2024/25: Total assets, capital structure and financial power rankings

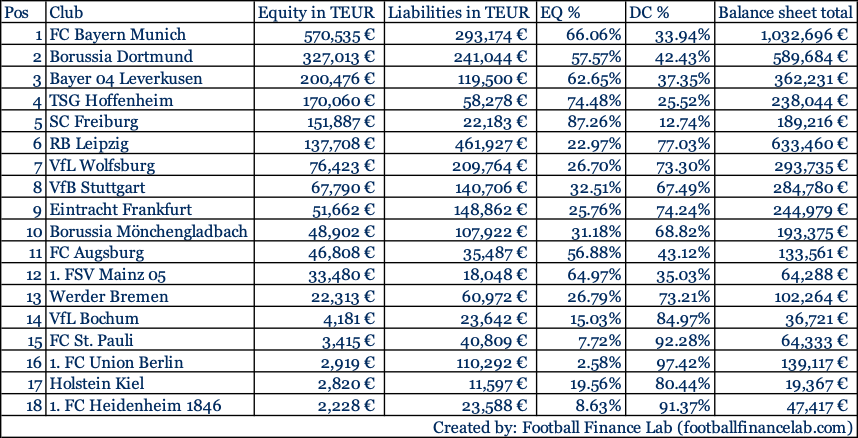

Finally, we take a look at the balance sheet total. The balance sheet total represents the total value of all assets of each association. It also shows the total value of all sources of financing. On the liabilities side (source of funds), which we examine in this article, these consist of equity, liabilities (representing borrowed capital), provisions (liabilities for future obligations/debts not shown in the financial year), deferred tax liabilities (future tax burdens) and prepaid expenses (expenses or income that have already been incurred but will only be spent later). Here is the table supplemented by the balance sheet total.

FC Bayern is once again in first place with total assets of over one billion euros. Surprisingly, Bayern is not followed by Borussia Dortmund this time, but by RB Leipzig. This also shows that the financial balance of power has now shifted in favour of Leipzig, which has the second-largest amount of money available for financing. Bayer 04 Leverkusen follows with approximately 362 million euros. Next come VfL Wolfsburg, VfB Stuttgart, Eintracht Frankfurt and TSG Hoffenheim with total assets of €238-293 million. Borussia Mönchengladbach with €193 million and SC Freiburg with €189 million follow in the middle of the table. Although Freiburg ranks fifth in terms of equity (and even first in terms of ratio), the lack of external financing means that its total assets are only enough for tenth place. Good external financing ensures that clubs have as much capital as possible at their disposal, which is not the case with the sports club. Union Berlin is one place behind Freiburg with approximately £50 million less in total assets. However, due to their high level of external capital, Union Berlin ranks 11th in terms of total equity despite being in 16th place. FC Augsburg and Werder Bremen follow with €133 million and approximately €100 million on their balance sheets. They are followed by Mainz 05 and FC St. Pauli with €64 million, which shows the large gaps between the clubs. Augsburg therefore has roughly the same total assets as Mainz and St. Pauli combined, even though they are only a few places apart in the table. Looking at Holstein Kiel, which has the lowest total assets, the differences become even more striking. Kiel has total assets of only €19 million, which is approximately 50 times less than FC Bayern Munich. The probability of one of the ‘small’ clubs beating the record champions is virtually zero, ensuring that clubs are regularly defeated by Munich. Even 1. FC Heidenheim and VfL Bochum, with total assets of €47 million and €36 million respectively, have twice as much money available on their balance sheets as Kiel. The total assets once again highlight the financial inequality that prevails in the Bundesliga and which, for example, has enabled Bayern to win 12 of the last 13 championships.

Pingback: RC Lens Financial Rise: Strategy, Transfers and Growth