After 19 match days, RC Lens is surprisingly battling Paris St. Germain for the French championship. Lens is thus closer to a championship than it has been since 1998, when it celebrated the first and only championship title in the club’s history. In this article, we will analyse what makes the club so financially strong and the strategy Lens uses to strengthen itself financially on the transfer market every year. Like most clubs in Europe’s top leagues, the traditional French club reports its financial results on a per-season basis rather than annually. The balance sheet for the 2024/25 season was recently published, and in this article we analyse all the relevant financial figures and developments over the last few years. This is important in order to understand RC Lens’ current financial position and how the club has developed off the pitch.

RC Lens’ 2024/25 Financial Results: Profitability, Revenue Decline and Key Cost Drivers

Let’s first take a look at the finances for the past season. Lens finished only eighth this season, missing out on international competition. Let’s first look at the income statement. The bottom line is positive, with a net profit of €3.75 million. However, if we look at the figures in detail, the picture is not so positive. Revenue of approximately €65 million is very low, but this is also due to the type of accounting, which we will discuss in more detail later. One of the reasons for this is that the club did not participate in international competitions in the 2024/25 season, whereas in 2023/24 it still played in the Champions League, which led to significant additional revenue. However, this cannot be the only reason for the halving of revenue. It indicates a fundamental negative trend on the revenue side, which poses a risk to profitability. The income statement shows another alarming figure. Operating profit before amortisation of goodwill shows a loss of approximately €70 million. This means that Lens would have to more than double its turnover in order to generate a profit from its operating result. How does RCL go from a loss of €70 million from its operating business to a net profit of almost €4 million in its overall accounts? The answer is simple: extraordinary income and expenses. Lens reports approximately €76 million in extraordinary income in its balance sheet. This shows that the club is incurring extreme losses in its operating business, which calls into question the long-term profitability of the club. Extraordinary income is income that is not generated from the core business of football. It can come from the sale of a stadium, training grounds or other properties, for example. But it can also be advance special income from sponsorship. From Football Finance Lab’s point of view, however, the most realistic option is the high transfer income that the club generated this season. According to Transfermarkt, the transfer balance was around €76 million, which corresponds exactly to the figure for extraordinary income. Income from player sales can be classified as extraordinary income in the balance sheet. This shows how dependent Lens’s profitability is on the sale of players and also how dangerous this can be for the club if these sales do not materialise. A one-off special payment from President Joseph Oughourlian, owner of an ad hoc fund that has owned the club since 2016, could also be a possibility. Not only did this fund purchase the club approximately 10 years ago, but Oughourlian has also been investing his private assets for years. However, the matching figures from Transfermarkt and the balance sheet suggest that this is solely attributable to the transfer balance. We will discuss the overall structure and developments under the president later in this article.

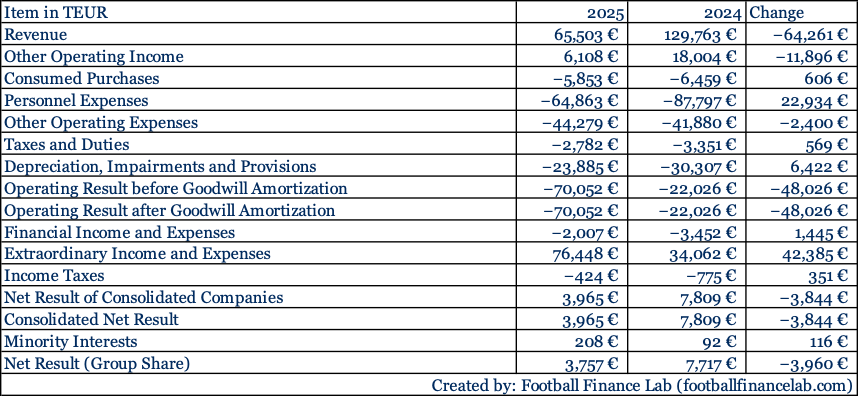

Let us now compare the profit and loss statement from the 2024/25 season with the previous season. While the massive decline in revenue has already been discussed earlier in the article, we will now look at savings. Personnel costs were significantly reduced. They fell by almost €23 million from approximately €88 million to €65 million, representing a saving of almost 25%. At €65 million, personnel costs would be roughly on a par with German mid-table club Mainz 05, which has staff costs of €66 million (the full analysis of staff costs in the Bundesliga can be found here). Depreciation and provisions also saved €6 million, which means that overall costs were reduced by approximately €16 million. However, this did not prevent Lens’ losses from rising dramatically. The loss increased by €48 million from €22 million to €77 million. In both seasons, player sales and the resulting extraordinary income resulted in a positive result of €3.7 million and €7.7 million in the previous year. The complete profit and loss statement for the 2024/25 season compared to the previous season can be found in the following table.

RC Lens’ asset and capital structure: Stability, equity growth and long‑term financial risks

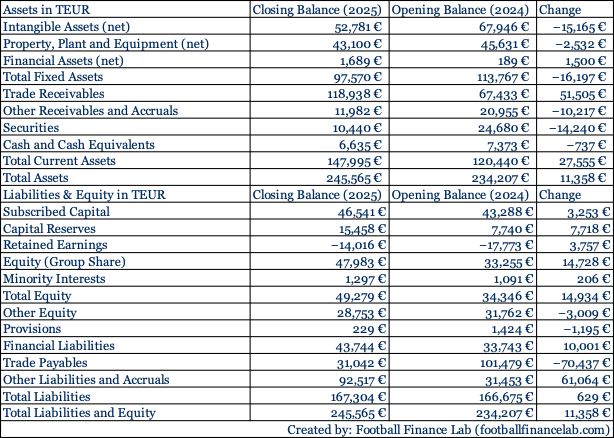

While the income statement provides an interesting insight into the association’s profitability and independence, in this section we want to analyse the asset and capital structure in order to confirm or refute the impression of long-term economic risk. Fixed assets fell by 16.2 million to 97.6 million euros. This is primarily due to a decline in intangible assets (-15.2 million euros). This is likely to be the result of income from player sales, which is recorded as revenue in the income statement but must be derecognised as assets. The high transfer revenues have another effect that is visible in the balance sheet. In assets, trade receivables rose by £51.5 million. This is due to delayed payments from player sales. As a rule, transfer fees are not paid in one lump sum, but in instalments over several years to the club selling the player. Total assets rose by €11.4 million to €245.6 million, representing a moderate increase in assets.

The capital structure also shows a positive trend. Equity rose by approximately €15 million to a total of €47.9 million. The total balance sheet also increased compared to the previous season, rising from €11.3 million to €245.6 million. Overall, the equity ratio is approximately 19.5%. Despite an increase of 4.9%, this is still a fairly low figure. Compared to the Bundesliga, Lens would rank 14th in percentage terms and 11th in absolute terms (the complete analysis of equity in the Bundesliga can be found here). In conclusion, it can be said that RC Lens had a financially successful 2024/25 season, with the many transfer revenues ensuring that the season ended with a profit and an increase in assets and capital. This further secures the club’s financial future and builds financial stability. However, this is urgently needed, as the club is extremely dependent on transfer income. For example, more revenue is generated on the transfer market than from all other sources of income combined. If transfer income were to dry up, the club would lose a lot of its economic viability and quickly slip into the red. The complete consolidated balance sheet for the 2024/25 season compared to the previous season can be found in the following table.

Extraordinary income at RC Lens: Transfer strategy, revenue dependence and sustainability

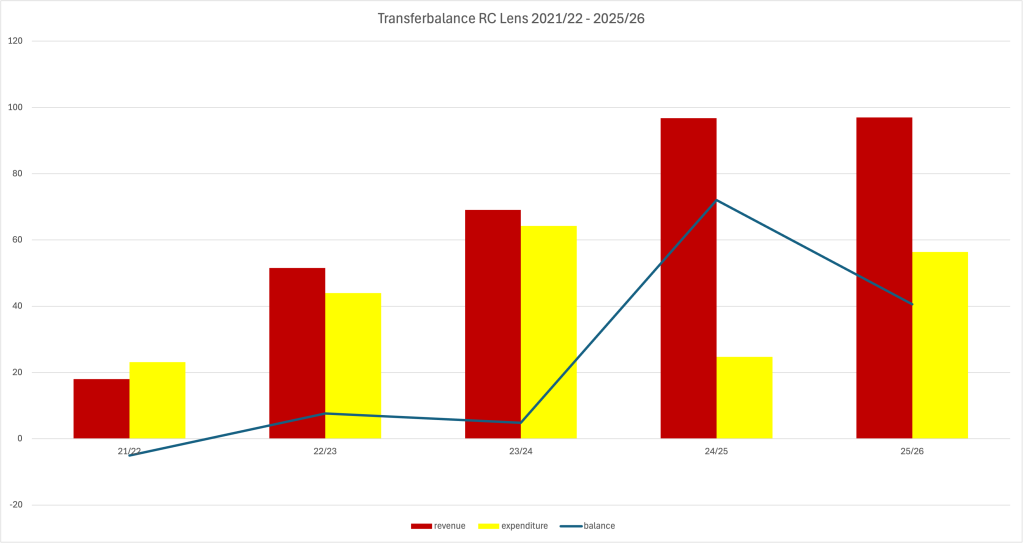

The financial development and consolidation is largely linked to the takeover by the current president, Joseph Oughourlian. He implemented a strategy of signing players for little money from largely unknown football markets, developing them and then selling them on to other clubs for large sums. There are various examples of this, such as Abdukodir Khusanov, who was signed from Belarus for €450,000 and sold to Manchester City for €40 million. But players from better-known scouting markets were also bought and sold at a profit. Other examples include Kevin Danso, who was signed from FC Augsburg for €8 million and sold to Tottenham for €25 million, and Neil El Aynaoui (bought for €600,000 and sold to AS Roma for €23.5 million). This strategy has been working very well for years and is currently Lens’ main source of income. The club’s current sporting success further promotes this by making players attractive to other teams and thus creating further value for the club. The transfer balances from the last five years are almost all positive, with the last three years showing particularly strong growth on the revenue side.

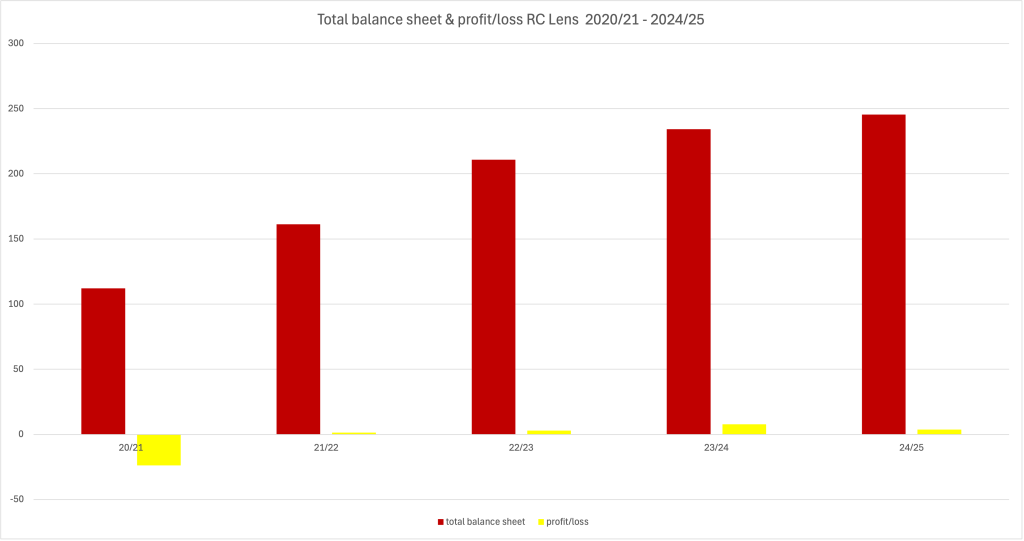

The total balance sheet total has also increased over the last five years. In 2020/21, the balance sheet total was €112.1 million, which is roughly half of the balance sheet total of the last balance sheet (€245.5 million). It should not be forgotten that the 2020/21 season in France was cancelled due to the coronavirus pandemic. Among other things, this led to a loss of revenue due to a lack of ticket sales and TV money, which is reflected in a loss of €23.8 million. In the following years, the balance sheet total increased steadily and a profit was generated in each financial year. The following chart shows the development of both parameters.

Joseph Oughourlian is also a shareholder in the Colombian club Millonarios and the Italian club Calcio Padova. However, there have been no transfers between the clubs to date, and Millonarios is managed by Oughourlian’s business partner Gustavo Serpa. It is therefore not a classic multi-club ownership construct. Further information on multi-club ownership and an explanation of the term can be found here.

Good job !

Our President saved our club 10 years ago and with our low budget we are in the top 4 if you cumulate the points from season 2022-2023 to the existing season. Not bad when you know we have the 10th budget of Ligue 1